Retirement Alpha Lowers Stress

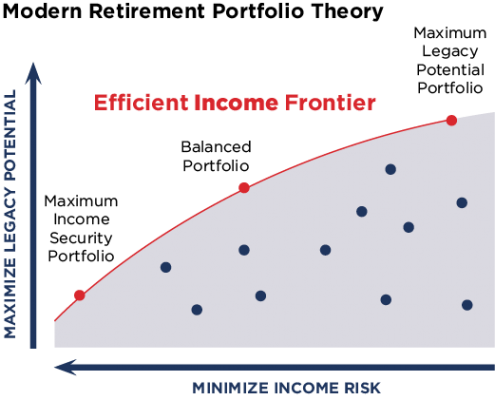

Retirement Alpha is the value you add to your clients through retirement planning, strategy, tactics and products.

It reflects the management of longevity risk with guaranteed lifetime income.

One of our biggest jobs as wealth managers is to protect our clients from unnecessary risk. The tools we use to diversify, allocate, rebalance and tax harvest have radically evolved in recent years.

There is a gathering Perfect Storm of Risk that could cause your clients major stress and heartburn.

- The 8-Year-Old Bull Market

- The End of the Bond Bull Market

- The Hidden Risks of Longevity

“Longevity risk is one of the key risks that can be managed effectively by an annuity. Investment and sequence risks are also alleviated through the more conservative investing approach for the underlying annuitized assets.”1

– Dr. Wade D. Pfau

Get your copy of Retirement Alpha in Today’s Market